Diesel is regaining ground thanks to a new report from the European Court of Auditors?

Europe risks a major flop with the end of thermal cars in 2035.

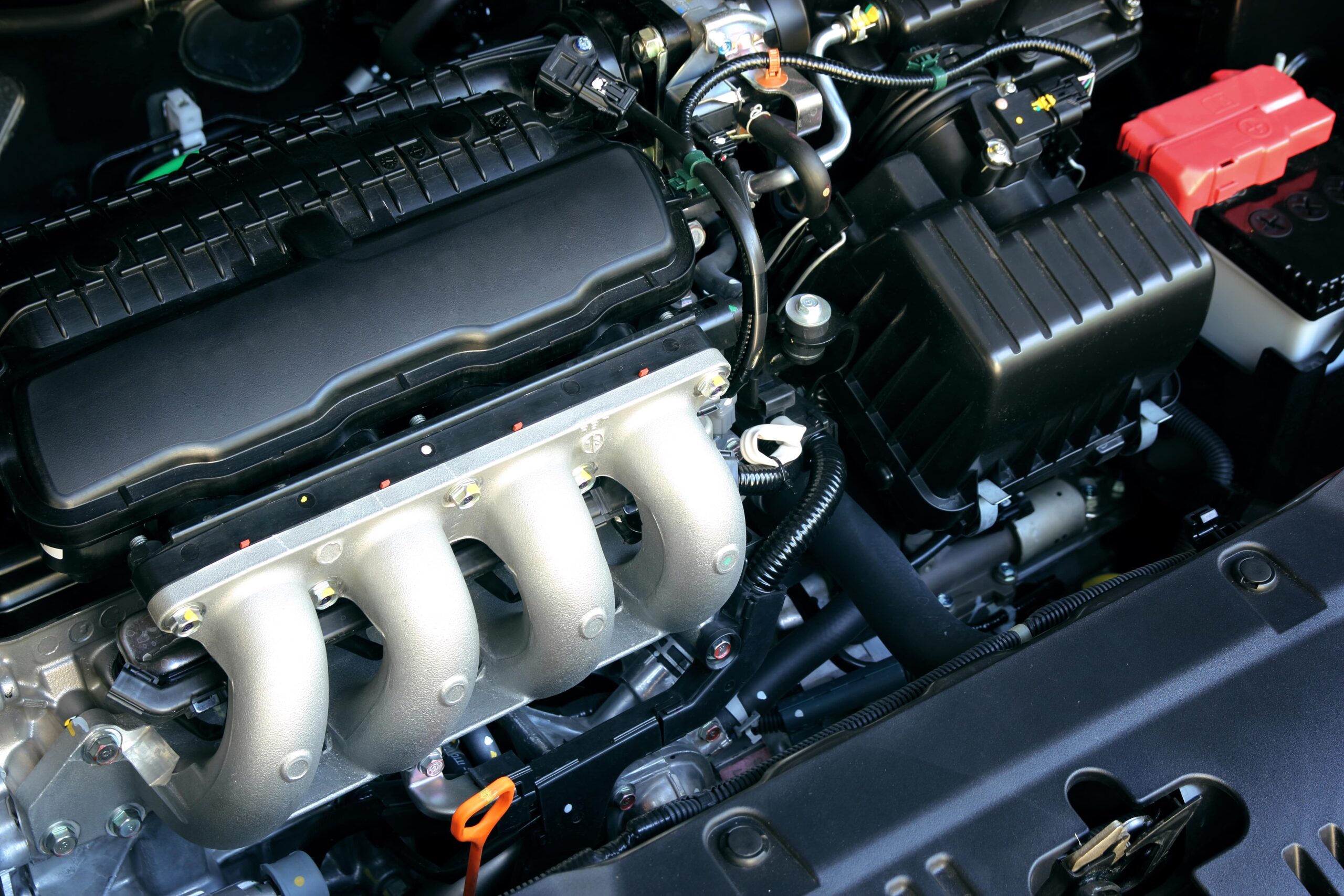

The European Union's ambition to phase out gasoline-powered cars by 2035 is looking increasingly difficult to achieve. A recent report by the European Court of Auditors highlights the immense challenges and potential consequences of this radical shift to electric vehicles. This article explores in detail this complex issue that threatens to present Brussels with a major technological and strategic dilemma.

The harsh reality of the Court of Auditors report

The European Court of Auditors has expressed doubts about the feasibility of a complete ban on combustion engines by 2035. The report highlights that, despite the ecological urgency of reducing CO2 emissions, the targets set appear unattainable. The EU's commitments to carbon neutrality by 2050 could be jeopardised by unforeseen obstacles.

Does this recent advance in fuel call into question the future of the electric car?

Car manufacturers' reserves

Particularly in Germany, the European automotive industry is showing serious reluctance. Brands such as Porsche continue to bet on synthetic fuels and are reluctant to give up their investments in conventional technologies. This hesitation represents a major obstacle to the transition to electric, revealing a general skepticism about the industry's ability to achieve such a radical change in such a short time frame.

The slow transition to electric

Europe is struggling to adopt electric vehicles, facing several major challenges, such as limited production capacity and reliance on imports of key components, especially from China. With only 10 % of global battery production located in Europe compared to 76 % in China, the EU is in a vulnerable position.

Resource issues

The report also sheds light on the difficulties in supplying raw materials needed to manufacture batteries, such as lithium and cobalt. With the majority of reserves located in China and Africa, Europe faces an increased risk of dependency.

Reluctance of European car manufacturers

The European auto industry, especially in Germany, has deep reservations. Renowned brands such as Porsche continue to favor synthetic fuels and are reluctant to abandon their investments in combustion technologies. This hesitation represents a notable obstacle to the electric transition, reflecting a general distrust in the industry’s ability to transform itself so radically in such a short time.

Slow transition to electric

Europe’s move towards electric vehicles is hampered by many obstacles, including insufficient production capacity and a reliance on imports of crucial components, mainly from China. With only 10 % of global battery production capacity located in Europe compared to 76 % in China, the EU is vulnerable.

Resource issues

The report also outlines the challenges of sourcing essential raw materials for battery production, such as lithium and cobalt. With reserves mainly located in China and Africa, Europe faces an increased risk of dependency.

Related posts